INDIA - 2021/01/15: In this photo illustration a Samsung logo seen displayed on a smartphone. ... [+]

SOPA Images/LightRocket via Getty ImagesSamsung’s stock has rallied by about 18% over the last three months trading at about $1,860 per share. So what are some of the trends currently driving Samsung’s business and stock price? Firstly, pricing for DRAM is likely to continue to pick up over 2021, driven by stronger demand from 5G smartphones, cloud data centers, and personal computers. Supply is also likely to be limited, as Samsung and rival SK Hynix - two of the largest producers - have scaled back on DRAM capital expenditures. Moreover, unlike NAND memory, demand for DRAM chips is relatively inelastic, meaning that customers typically can’t scale back on orders as prices rise. This should bode well for Samsung, as DRAM is one of the biggest drivers of its earnings. For perspective, about 52% of Samsung’s operating profits over 2020 came from its semiconductor business and it’s safe to assume that a bulk of the semiconductor profits come from the DRAM business. That said, Samsung’s profits could face some pressure in the near-term due to weakness in the U.S. dollar, which remains down by about 7% over the last 12 months versus the Korean Won and also due to higher costs from some of the company’s new semiconductor fabs, which are just ramping up production. What Has Driven Samsung Stock’s 55% Gain Since 2017?

[1/5/2021] After A 50% Jump In 2020, Are Further Gains Ahead For Samsung Stock?

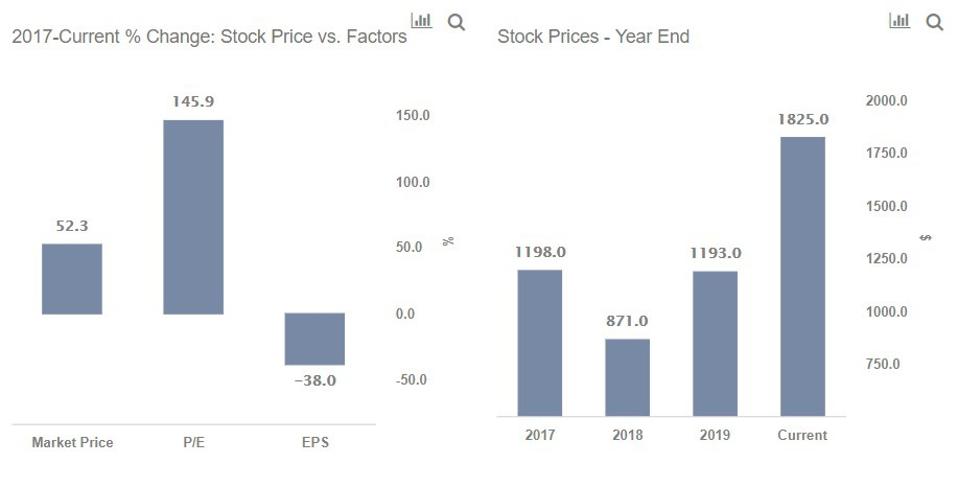

Samsung Electronics had a solid 2020, with its stock price rising by more than 50% over the year to levels of around $1850 per share. Although the company’s flagship smartphone business faced some headwinds, this was more than offset by higher demand for memory products from the PC and mobile device space and the growing “stay-at-home economy,” which boosted sales of the company’s typically slow-growing TVs and home appliances segment. Are further gains in the cards for Samsung? Let’s take a look at what’s driven the gains in Samsung’s stock price in recent years and what the outlook for the company’s key businesses could be like. See our dashboard analysis on What Has Driven Samsung Stock’s 52% Gain Since 2017? for a detailed overview of how Samsung’s Revenues, Margins, and multiple have changed in recent years.

What Has Driven Samsung’s Stock Price In Recent Years

Samsung’s Revenues declined from around $211.9 billion in 2017 to about $208 billion in 2019, as DRAM prices, which surged over 2017 amid a supply crunch, saw declines. However, Revenues improved over the last 12 months, driven by improving semiconductor and consumer electronics demand. Samsung’s Net Margins declined from 17.6% in 2017 to about 9.4% in 2019, as Revenues from the high-margin memory business moderated, although they improved slightly to about 10.6% over the last 12 months. Samsung’s EPS also declined from levels of about $131 in 2017 to $81 over the last 12 months. However, the markets have been valuing Samsung more richly, with its P/E multiple rising from about 9.1x in 2017 to about 22.5x currently (based on trailing 12-month Revenues). While this is partly due to low-interest rates and a broader shift to equities, investors probably think that the increasing digitization of the economy through and post Covid-19 is likely to bode well for Samsung’s semiconductor, display, and mobile devices businesses, helping it to drive profits in the long-run.

DRAM And 5G Cycle Likely To Drive Earnings In 2021

There are multiple trends that are likely to help Samsung’s performance in the near to medium-term. Firstly, the DRAM market, which is one of the biggest drivers of Samsung’s profits, is likely to look up over 2021, driven by higher demand from the server market, as companies are expected to boost capital expenditures after scaling back in 2020 amid fears of a long Covid-19 recession. Supply growth for DRAM is also likely to be limited, as the industry starts transitioning to the next-gen DDR5 DRAMs, which are apparently more difficult to manufacture. Separately, the upgrade to 5G networks is also expected to increase semiconductor content in mobile devices, helping Samsung’s logic chip business. Samsung’s mobile handset business is also likely to benefit from the 5G trend, as the company begins to transition mass-market models to the next generation wireless technology. That being said, we are not sure that the demand increase over 2021 will translate into further gains for Samsung’s stock price, given that its valuation multiple has expanded considerably in recent months in anticipation of the gains.

MORE FOR YOU

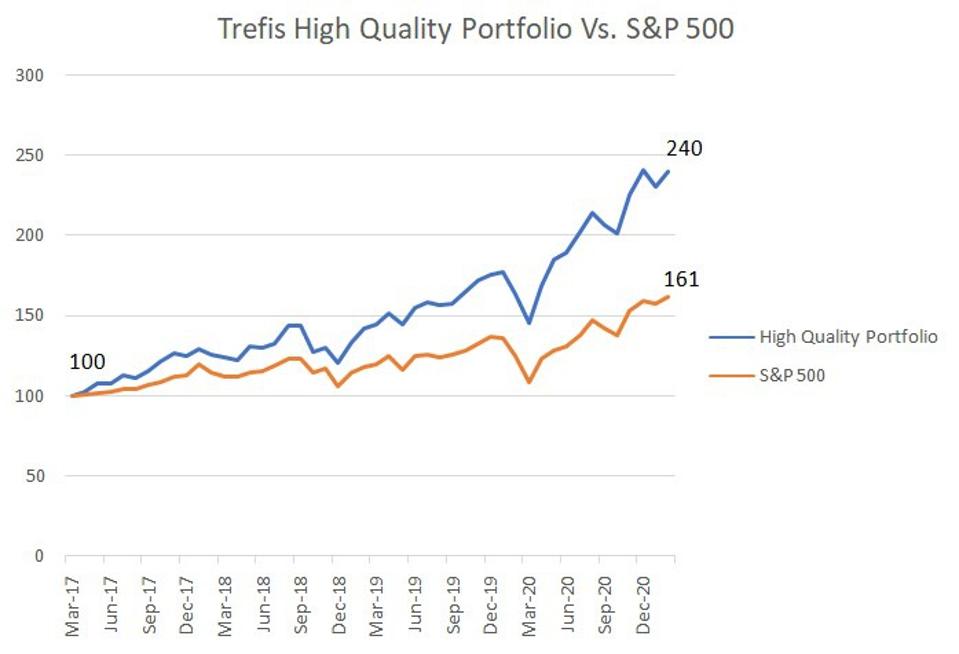

High Quality Portfolio

TrefisWhat if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with around 130% return since 2016, versus about 65% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

March 03, 2021 at 09:00PM

https://ift.tt/3e5xtGU

What’s Happening With Samsung Stock? - Forbes

https://ift.tt/2O3clnm

/article-new/2021/06/iphone-13-duan-rui2.jpeg?lossy)

No comments:

Post a Comment